When the Tesla Model S came out in Hong Kong many years ago, there were a lot of talk about how expensive the insurance was and how much it costs to repair the car even for minor bodyworks. The use of aluminum in the Model S means that most of the body cannot be fixed with traditional means like steel could but needs to be replaced panel by panel which increased the costs tremendously. Moreover, body parts were not only at a premium but it sometimes takes months on end for the body part to arrive from the United States.

Fast forward to the Model 3, the Model 3 is a mix of steel and aluminum which means a minor fender bender could be repaired normally like any other cars. Although, compared to my previous internal combustion engine car, the Model 3 insurance is still more expensive than my previous car. Nonetheless, there are many factors that influences the cost of insurance of a private motor vehicle in Hong Kong.

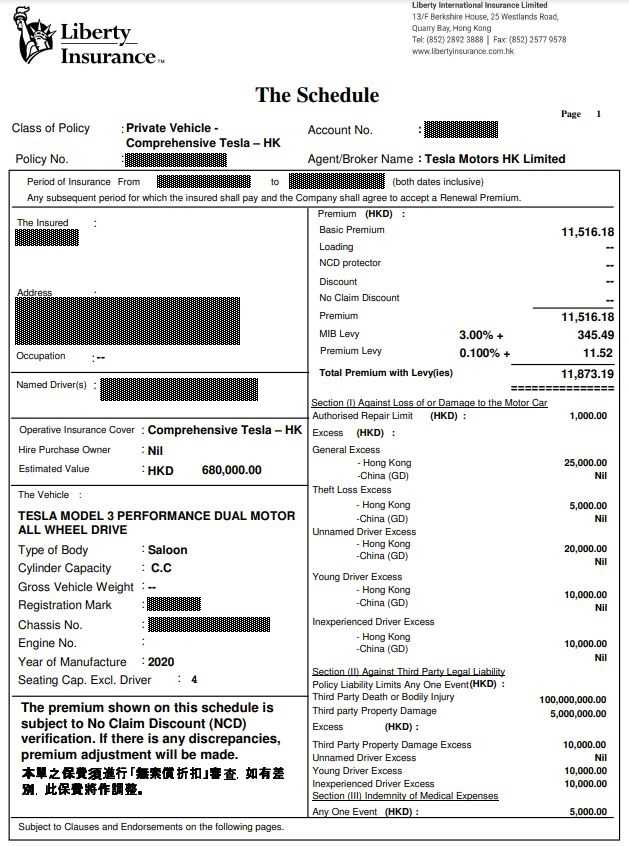

Tesla Hong Kong appointed the insurance company, Liberty Insurance, to insure all Tesla vehicles in Hong Kong. In Liberty Insurance website, they state that, “Tesla is appointed and registered under the Insurance Ordinance as an licensed insurance agent for Liberty International Insurance Limited (“Liberty Insurance’). Liberty Insurance is an authorized insurer regulated by the Insurance Authority under the Insurance Ordinance. Liberty Insurance underwrites Tesla’s InsureMyTesla program in Hong Kong, offering a mileage-based insurance product specially designed for Tesla owners.”

Annual Insurance Costs

Normally, insurance for private motor vehicles are based on a number of factors such as the engine’s cylinder capacity of your car. The higher the C.C your car is, the more expensive the insurance. However, there is no engine in an electric vehicle so Liberty Insurance have a scheme where part of the insurance costs is based on the mileage you drive. If you purchase your Tesla new from Tesla Hong Kong, your mileage information will be automatically shared with Liberty Insurance. The yearly insurance costs will be based on your mileage driven and other factors such as No Claims Discounts etc. which is the same for any vehicle insurance in Hong Kong. Below is my full comprehensive insurance annual costs with Liberty Insurance for my Tesla Model 3 Performance on the 2nd year of driving.

I am not going to comment on the costs as most of us will compare to the costs of insurance of our previous or current cars. You can make your own judgement as to how expensive it is compared to your current non-EV. If you are not a car owner now, then you could gauge the approximate yearly insurance costs of a Tesla. If you drive another Tesla model or with lower or higher mileage driven than me, maybe you could share your insurance costs in the comments so we know the difference.

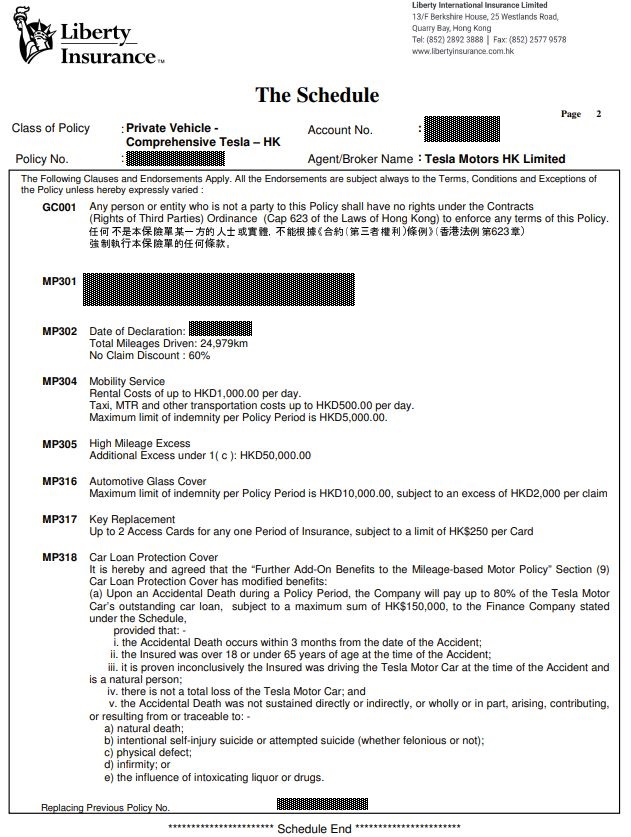

Annual Licensing Costs

In order for any motor vehicles on the road to be roadworthy (i.e. if we need to drive the car on the road), we need to pay an annual licensing fee. For normal internal combustion petrol engine cars, the fee is based on the engine’s cylinder capacity. For electric vehicles, it is based on the weight of the car since it has no engines.

For most electric vehicles, the majority of the weight comes from the battery. The larger the battery usually means the larger the car thus the heavier the car as well. Every year Tesla models have some variation in the weight of vehicle as the battery might weight slightly different and the capacity might also be slightly different. For my 2020 Tesla Model 3 Performance, it weight 1,860kg with a 79.5kWh battery. From the table above, my annual licensing fee is $572+$496 ($124×4) + $114 (Levy) = HKD$1,182.

As you can see from the table, it is actually significantly cheaper than a petrol car’s licensing fee. Even for the smallest 1,500c.c. petrol car, the annual licensing fee is HKD$5,074.

The licensing fee seems to change annually but hopefully the government of Hong Kong would continue to maintain this relatively low annual licensing fee for all electric vehicles in Hong Kong.

The insurance for a Tesla is generally more expensive than a normal petrol car but I believe the annual licensing fee offsets the high insurance costs meaning the costs of ownership is much more comparable to a normal internal combustion petrol vehicle in Hong Kong. Moreover, the savings from gasoline in itself should cover the insurance costs alone.

My experience with Liberty Insurance has been good. Everything is completed online and the response via email is fast and efficient. I had a cracked windshield claim which was processed quickly and smoothly. (A blog post of that experience soon.)

I hope this will give you a better sense of the ownership costs of a Tesla in Hong Kong. Of course, parking is the major issue for owning any private vehicle in Hong Kong with astronomical costs of parking in some districts. Driving will never be a necessity in Hong Kong. With limited space and in one of the most densely populated urban landscape in the world, driving could never be the prevalent mode of transport in Hong Kong.